20 February . 2024

What it Takes to Buy a New Home in 2024

Atop Mt. Rainier you can see for hundreds of miles in any direction. Among those many miles and millions of acres you won’t see home prices or what the housing market is doing. Chances are, if you’re all the way up there you’re wondering how you can be as close to this unmistakably gorgeous landmark for the rest of your life.

There are many beautiful places to live in the PNW and one of them ranks among the best for its proximity to stunning nature, high paying jobs, and great schools. In Tehaleh, this must be the place. You’ll find neighbors from all walks of life in various points of their journey. You’ll be surrounded by adventurers, storytellers, and good people who appreciate good company.

So, coming down from the mountain, how does one navigate the current housing market and what can a person do in order to live in such an interesting community like Tehaleh?

Let’s focus in and take a look at the state of the housing market in Washington and see what it takes to buy a new home in 2024.

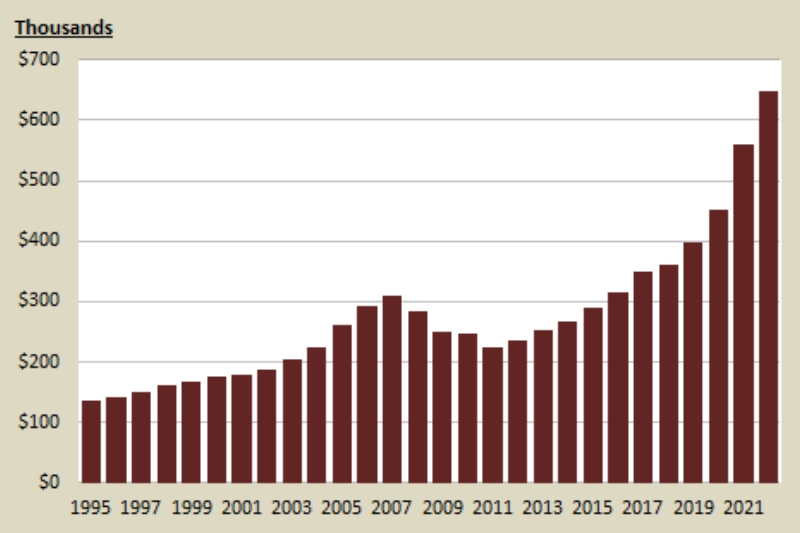

Median costs of a home in Washington state

The median home price in Washington state has increased from $362,100 in 2018 to over $647,900 in 2022. The rapid increase in home prices has leveled off a bit and has fallen to about $587,200 as of January 2024.

That being said, comparing house prices in the very expensive Seattle metro and the more reasonably priced Pierce County will help you understand the pros and cons of buying a home in Washington state.

- Pierce County has a median sale price of $535,000.

- King County has a median sale price of $775,000.

Paying note to property taxes also helps determine what is most affordable. Not only are house prices typically cheaper in Pierce County than they are in King County, but the property taxes are as well.

- Median taxes in Pierce County are about $2,759.

- Median taxes in King County are about $3,572.

Washington Property Taxes By County - 2024 (tax-rates.org)

Consider these savings as a way to help build up your emergency fund year after year. $800 may seem small at first, but over the course of a 30-year mortgage? Those savings could be used for necessary home improvements or to help you resell for your next home.

Town vs. City

Being directly in the city offers its advantages as it can make your daily commute more palatable. But as the popularity of hybrid work has soared, living in a cramped 2-bedroom condo without a yard and with shared walls has understandably become less favorable. After all, the occasional commute is something many folks are willing to adjust to if it means building greater equity in a home.

Each person’s situation varies and to figure out whether the savings are worth it, there are several other aspects in this housing market worth exploring.

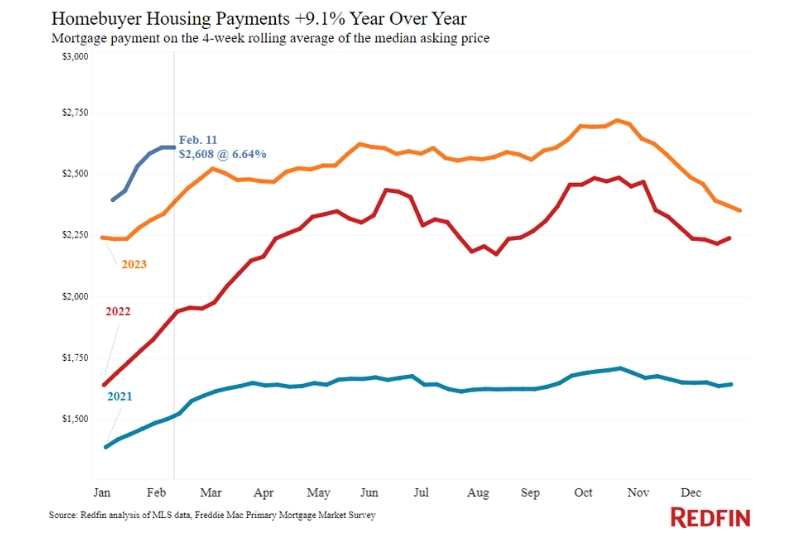

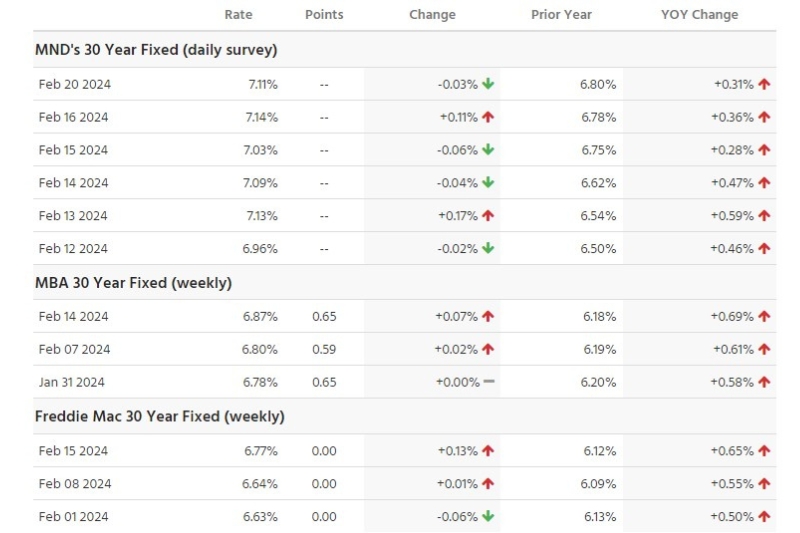

Interest rates are higher, but you have options

As of the time of this writing, 30-year fixed mortgage rates will run between 6% and 7.5%. Comparing these numbers to the wildly low mortgage rates during the pandemic may create a bit of envy. There is one thing worth mentioning: competition has simmered, and prices have cooled.

Interest rates typically lower as the economy stabilizes. When those interest rates lower, people wishing to time their home purchase perfectly will more than likely turn the market hot. At this moment in time when rates are slightly higher than usual, you can jump in and beat the competition.

If/when rates stabilize, you can choose to refinance to meet those lower rates. It may appear like imperfect timing, but because of that, home prices look to be a more attractive price now than they may be in a year or two.

First time home buyers

20% down on a $500,000 home can be a scary number for people who have never bought a home. For example, if you’ve saved every penny you’ve worked hard for and have $50,000 overall – you might be wondering where all the $250,000 homes are. Thankfully there are options.

Rather than putting 20% down on a home, first time buyers have the option to put less down. However, this type of mortgage situation will usually require Private Mortgage Insurance (PMI). PMI acts as a safeguard to protect the bank/lender. You’ll pay these monthly dues until you’ve met the 20% down payment number.

PMI can be a helpful tool for homeowners who can afford the monthly cost of a home but have been unable to save the full amount of today’s expected down payments.

New home vs older home.

Buying an older home comes with a lot of caveats and sacrifices. For instance, it was built for a different time and while it may have modern updates, there could still be drawbacks to the original build.

A couple things you may notice:

- Older homes are usually less energy efficient.

- In the PNW of yore, who needed AC?

- Plumbing technology has changed drastically.

- Cozier room design? Sometimes feels constrictive.

- Outdated appliances and builds require specialists. Specialists cost $$$.

- Foundation issues can be hard to notice if you’re not sure what to look for.

- Outdated electrical systems.

What’s great about a new home purchase is that you will pay the same price every month when you’re locked in to a 30-year mortgage. Your 30-year-old well-taken care of home will have appreciated in value. That 70-year-old home today will require quite a bit more maintenance in those 30 years. Let’s take a look at some of those repairs you may have to encounter with an older home.

Is it a fixer upper or a money pit?

- Roof replacement: asphalt shingles $12,000 - $15,000

- Siding: for vinyl siding could cost $16,000 to $30,000

- Septic tank repairs: $600 to $3,000 where a full replacement can cost $2,000 to $20,000.

- Water heater: about $1,000 for a storage tank water heater. Tankless water heaters run about $2,500.

- Furnace: up to $6,000 depending on if it’s gas, electric, or oil.

- AC installation: most older homes don’t have central air, and if they do they may not be as energy efficient as the options nowadays. This cost would likely be somewhere in the $5,000 range.

- Fresh paint: chipped paint is an easier fix but can cost a pretty penny too – between $1 and $3 per square foot.

- Foundation repairs: over time the foundation can crack, especially with occasional seismic activity in the area. Big foundation repairs can run into 5 figures ($25,000)

- Mold remediation: this climate can do a number on homes that aren’t well-maintained. This can cost about $2,500 but could vary depending on the severity of the situation.

Are new homes hard to find?

The Puget Sound is dealing with a housing shortage, which has been the main cause of skyrocketing prices throughout the area. Many new builds are townhouses, condos, and apartment buildings. While these builds are ideal for young professionals awaiting a turnkey home, the cost of a larger family home is often out of range for many.

In Tehaleh, there are so many options for homebuyers of all walks of life. Young families can find a price point in their range and build a life in a turnkey home. Homeowners living small in the city can change gears and find a suitable home to fit their growing family. Retirement can call for downsizing, but there’s no need to sacrifice on a growing social life. Tehaleh has it all!

As you’re mulling over your search in the Puget Sound area, you’ll keep wanting to compare what you see for what’s possible in Tehaleh.

Tehaleh’s newest expansion, Glacier Pointe, has a handful of builders who would love to show you what is possible in building a new home. Choose from Azure Northwest, Brookstone, Garrette Custom, Lennar, MainVue, Richmond American, Shea, and Tri Pointe to start customizing the home you wish to grow with your Mt. Rainier view.